Frontier Market Focus

December 18, 2012 2 Comments

Nigerian Cement Sector

Global Perspective

In this current economy of sovereign debt crisis, slowing demand and slowing growth from the developed countries, global cement producers are facing difficulty. In Western Europe for example, where the biggest companies have a big market share, the construction activities have been on a decline since the onset of 2010. The EU zone debt crisis further slowed down the recovery as the governments embarked on fiscal cuts resulting in the reduction of the expenditure of infrastructural public projects which would normally stimulate construction activity and the demand for cement.

While I see some potential in European frontier markets, the expected slow-down in growth in more developed markets would cause an overall strain on earnings growth from the European market as a whole. Apart from Lafarge, who are increasing their presence in almost all the Africa regions, (they increased their business from 27% in 2010 to 33% in 2011), the other major global players (Holcim and Heidelberg) only operate in one or two African regions, yielding themselves c6% and c1% of sales revenue respectively from Africa. This leaves the room open for companies like Dangote Cement Plc and Ashaka Cement Works to grab a fair share of the market.

On the 12 December, Ben Bernanke, chairman of the Federal Reserve, the central bank of the United States announced another round of quantitative easing (QE4) at a rate of $85 billion a month until the U.S unemployment rate falls below 6.5% and inflation projections remain no more than half a percentage point above 2% two years out.

We’ve already seen the slowed growth of the developed market, but due to this new round of liquidity being pumped into the market we can see both good and bad news as a result of this. The investor desire for higher yields will cause a flow towards emerging market economies, investment grade emerging market bonds, equities and other general assets. This increased wealth and economic activity will lead to higher inflation. Because some of these economies are still emerging (underdeveloped), they may not necessarily have the capacity to meet the new higher demand due to inefficiencies. These supply side shocks coupled with inflation will eventually deter initial levels of growth that incentivised the influx of the excess liquidity. This began with Brazil and India, and in my opinion this excess liquidity will speed the process up, stifling the growth of these emerging nations even more.

Economic growth in Brazil and Asia will gradually slow down over the next decade. Though the African continent still lags significantly in infrastructure, I am convinced the next pioneer of global economic growth will be Africa; especially Sub-Saharan Africa (excl South Africa) to gradually trend up on the back of increasing discovery of mineral resources, strong commodity prices and improving political landscapes.

Based on the above, I make a case for Africa as the next frontier of global economic growth, with Nigeria’s Cement Sector strategically positioned to drive the expected growth in physical infrastructure.

I’ll focus here on potential for growth and speak in terms of the amount of growth that has already taken place coupled with the amount of growth is that is yet to take place. Speaking in those terms, there’s a lesser potential for the infrastructural development in advanced and fast growing emerging market nations, and even less in the developed countries; thus Africa has the highest untapped potential for economic growth and infrastructural development.

According to the World Bank report, ‘African Infrastructure: Time for Transformation’, infrastructure has been responsible for more than half of Africa’s recent improved growth performance and has the potential to contribute even more to the future. The cost of addressing Africa’s infrastructural needs is around $93 billion a year. The major deficits in housing and other physical infrastructure in Africa is more concentrated in West, Central and East African sub regions. Our focus here is on Nigeria, which due to the size of its population we see a high prospect for infrastructural development. So I foresee the Nigerian cement sector as a vehicle for substantial potential for growth.

Nigeria’s Cement Sector

Around two years ago, Nigeria was lagging behind the likes of Egypt and its North African neighbours in terms of cement production capacity. In 2010, the average cement consumption per capita for North Africa was slightly above 300kg, the highest on the continent, whilst that of Nigeria was around 105kg per capita. These dynamics have changed with the likes of Dangote Cement Plc and co in the market, Nigeria has become a robust producer of its own cement.

Investment areas for Nigeria’s cement sector:

- Rail and Ports Construction: The use of concrete ties in railroad construction has meant a significant surge in cement demand around the world, thus in Nigeria the current state of the railroad network provides a major opportunity for continuing growth in the cement sector.

- Vast Raw Material Deposit: Infrastructural boom and abundance of raw materials would also encourage cement production.

- Roads: Only 30% of Nigeria’s road network is paved. Last month the Managing Director of Lafarge Cement called on the Nigerian government to explore more ways of using cement, especially in the construction of roads.

- Housing Deficit: Nigeria has a deficit of about 17 million housing units, according to industry specialists. This means that even if Nigeria has one thousand housing units every day; it will take Nigeria about 50 years to meet the present housing demands and that is if the population remains constant.

The total supply of cement to the Nigerian market at the end of November 2012 was a record 11.4% higher than by the same point in 2011. This was due to a combination of increase in local production of cement and the continued import of subsidised cement into the country. Local supply now exceeds demand.

Brief Producer Overview

In October this year, the chairman of the Cement Manufacturing Association of Nigeria (CMAN), Mr Joseph Makoju, made a statement that signified Nigeria’s self-sufficiency in cement production due to the aggressive growth of cement producers in an effort to encourage local production against importation. CMAN have aided to make cement cheaper and available to the consumers as local production rose from 2 million metric tonnes in 2002 to 13 million metric tonnes in 2011- c17million MT this year. The chairman also expressed the need for more cement plants in Nigeria to sustain the gains achieved in this age of self-sufficiency.

In this age of self-sufficiency for the Nigerian cement industry, one firm that has lead this progress is, Dangote Cement Group Plc, listed on the Nigerian stock, has led the Nigerian cement industry in capacity expansion initiative. Between 2005 and 2011, Dangote Cement spent unprecedented $6.50 billion on ramping up its production capacity.

Beside the aggressive drive, the company has developed strategies for distribution in 14 other African nations. Interestingly, Dangote Cement Plc. is planning to build a Pan-African cement empire stretching from Senegal to Ethiopia.

The other producers that conclude the top 3 cement producers in Nigeria are:

- Ashaka Cement Works

- Lafarge West African Portland Cement Company (WAPCO) Plc

Ashaka Cement Works

Ashaka Cement Works is located at the North Eastern corner of Funakaye Local Government Area (LGA) of present day Gombe State. It is bounded by notable villages which includes; Bage, Gongilla, Badabdi, Bungum, Feshingo, Maza, Ashaka-Gari and the nearest to the Ashaka Cement Site, Jalingo. The Company is a subsidiary of Lafarge SA and is involved in the manufacturing and marketing of cement products in Nigeria. The Company’s operations are organized into two divisions: Aggregates and Concrete, Cement and Gypsum.

Highlights

- Ashaka Cement has reported a profit rise of 54% for the second quarter ended June 30, 2012. The result released on the floor of the Nigerian Stock Exchange (NSE) showed a turnover of N12.261 billion in 2012, compared with N10.22 billion in the corresponding period of 2011.

- With relatively stable prices in 2012, I believe uncharacteristically strong QoQ decline in Q3 12 revenues was compounded by a reduction in volume sales.

- Gross margin was flat QoQ at 32% in Q3 12 and existing fuel inventories apparently tided the company through the quarter after significant reported increases (26%) in Low Pour Fuel Oil (LPFO) prices during the period, while steady margins suggest further progress with coal fuel substitution (from LPFO) has been limited at best.

Lafarge WAPCO

Lafarge WAPCO is a cement manufacturing company in Nigeria owned by Lafarge SA, Paris. It stands to enjoy high value creation from the Lafarge branding equity as the Group introduces a turning point to display customer orientation, technical excellence and innovation from the branding platform. WAPCO is one of the oldest cement manufacturing companies in Nigeria. Its nature of business includes the manufacture of cement and paints, repairs of electric motors, etc.

Highlights from Last Financial Report

- Lafarge WAPCO reported H1 ‘12 turnover growth of 57% YoY to N46.3billion as sales continued to soar on the back of an increase in volumes dispatched, even as factory gate prices remained stable during the period at N1400 per 50kg bag. A pick up in operations at Lafarge Ready Mix Nigeria Limited, a wholly owned subsidiary of Lafarge WAPCO, which began producing ready-mix concrete products late Q4 2011 also contributed to the rise in turnover. For Q2 2012, turnover rose by 56% YoY to N23.727bn, falling short of our forecast of N26.6billion. Nevertheless, I attribute a 5% QoQ growth in revenues to increased capacity utilization at the new plant.

- Cost of Sales rose 31% YoY mainly owing to increased dependency on LPFO for manufacturers facing lingering gas supply shortages in the country. Average LPFO prices soared 19% YoY in H1 ‘2012 after peaking in April.

- COGS nevertheless rose at a slower pace than turnover, and gross profit margin consequently expanded to 39% in HI ‘2012. The company continues to press ahead with its program to substitute LPFO for cheaper coal in addition to new gas plants; as such I expect the energy costs component to decline in the medium term.

- In H1 2012, interest expense reached N2.58billion, significantly larger than N64.7million recorded in the same period last year, reflecting the onset of interest charges on debt used to finance the expansion project; as at FY ‘11 Wapco had a loan balance of N53.7 billion, all due for repayment within the next five years.

![]()

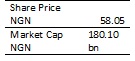

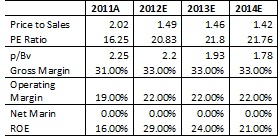

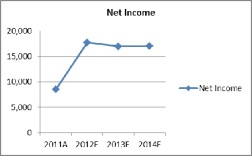

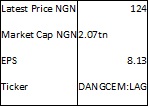

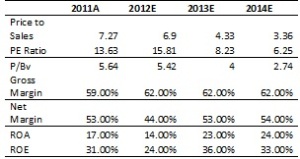

Dangote Cement

Dangote Cement Plc., formerly Obajana Cement Plc., is a Nigeria-based company engaged in the building materials industry. The company is primarily involved in the operation of production facilities for the preparation, manufacture, control, research and distribution of cement and related products. The company operates Obajana Cement Plant, which consists of two production lines with combined capacity of five million metric ton (MT), and utilizes natural gas as the primary fuel source for firing the kiln and powering the plant. The Company also manages a cement production plant in Ibese, as well as four terminals, two in Lagos and two in Port Harcourt, through which it imports cement. Dangote Cement Plc. is a subsidiary of Dangote Industries Limited (DIL), which owned 94.87% of its issued share capital as of 31 December 2010.

Highlights

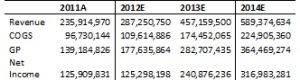

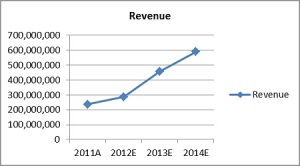

- Dangote Cement Plc. (DCP) reported 9M 12 turnover of N208.3 billion, a 20% YoY rise from a comparable period last year. Cement sales however dropped from 2,879kt in Q2 12 to 2,430kt in Q3 12, translating to a 15% QoQ decline in revenues to N66.2billion.

- COGS however declined by 22% QoQ due to efficiency gains from greater utilization of gas in its energy mix relative to LPFO. Management confirms that gas supply returned to 95:5 gas to LPFO usage in July and August for Ibese Production Plant rising to 100% in September.

- For the 9 month period, gross profit rose 22% YoY to N130billion in line with our N131.1billion forecast, as the increased energy efficiency and a 100bps YoY increase in gross profit margin to 62% in 9M 12 offset revenue shortfalls. However, a 21% YoY rise in operating expenses pressured operating profit, which I attribute primarily to higher distribution expenses also on the back of higher fuel costs and road closures. This was somewhat ameliorated by a 61% YoY increase in other income which rose by N2.6billion to N6.6billion in 9M 12, leading to a 24% increase in operating profit to N115.5billion over the same period.

- EBT rose 13% YoY to N105.8billion in 9M 12, just short of our N107.9billion forecast.

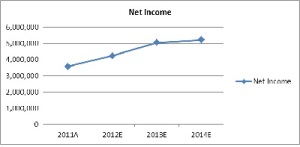

- I expect revenues to grow steadily in the forecast horizon as government infrastructure projects remain a major priority in the medium term and constitutes a major aspect of domestic demand.

- Dangote Cement recently shut down the Gboko plant, according to the management, this was due to a flood of cement imports into the Nigeria.

In Conclusion…

As the Nigerian cement industry continues to invest in being a dominant regional supplier, cement producers within other regions should brace themselves for aggressive market competition in 2013 and beyond. With the likes of Dangote Cement and Co making the country more self-sufficient in its cement industry, there is no reason Nigeria should not begin to look forward to checking “Cement Exporter” off its list.

Great analysis and mastery of the topic.

In Kenya we’ve had the Housing boom for the last 2 decades and it is still going strong. our cement industry is booming. Keep up

Thanks!