How to Trade Kenya-The buy case for Long End Kenyan Bonds

November 27, 2018 Leave a comment

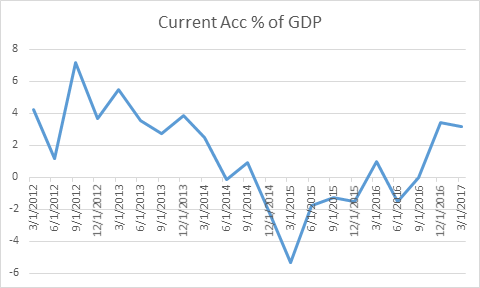

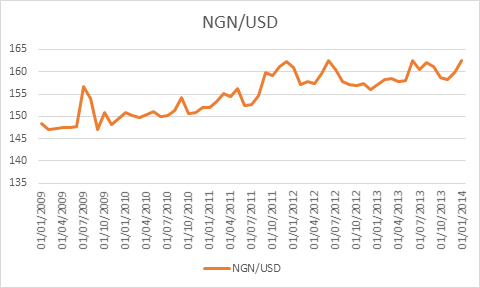

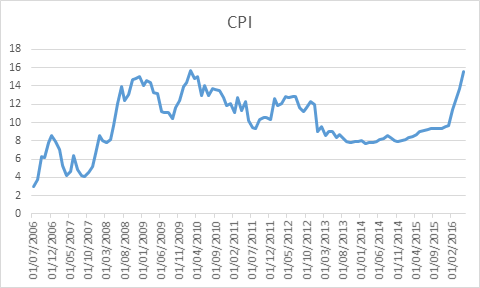

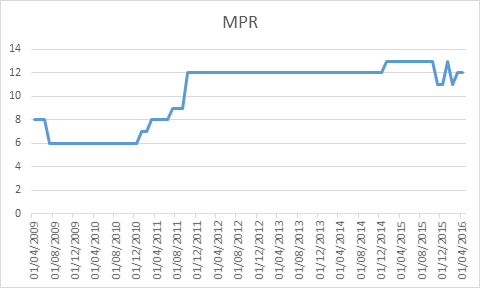

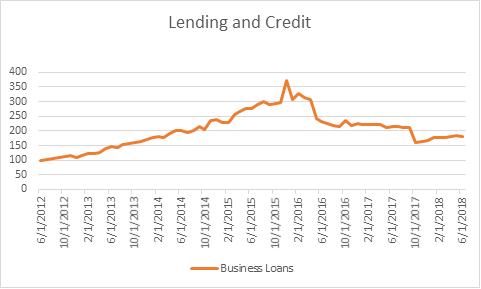

Since the legislative interventions into interest rate determination in September 2016, investors in Kenyan debt markets have been trying to figure out when the rate cap is likely to be removed or at least amended. For those unfamiliar, Kenyan lawmakers placed a cap on lending rates at 4 percentage points above the Central Bank of Kenya (CBK)’s policy rate in an attempt to limit the cost of borrowing for businesses and individuals and increase credit growth. Though the CBK eased policy rates to 10% subsequently, Kenyan banks unwilling to lend to high risk tiers have redeployed their balance sheet towards short dated government securities.

As such instead of an increase in credit growth, the rate cap has drawn an opposite reaction as most commercial banks have decided to reduce lending. The index below tracks the outstanding amount of credit (or loans) extended to businesses and consumers.

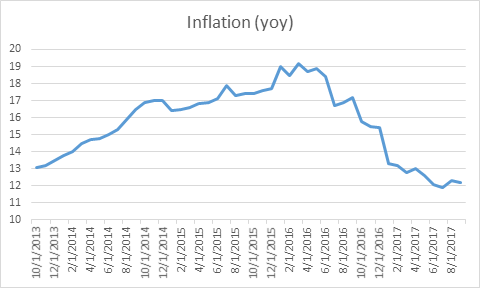

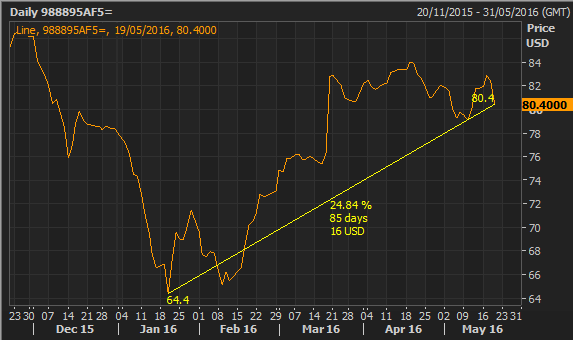

To bolster interest income Kenyan banks decided to go to the capital markets to buy government debt in search for better rates in the bond markets. This increase in bond appetite compressed local bond yields significantly causing bonds in the long end to trade around 14%, 400bps above the lending rate of 10% at the same price of the lending cap.

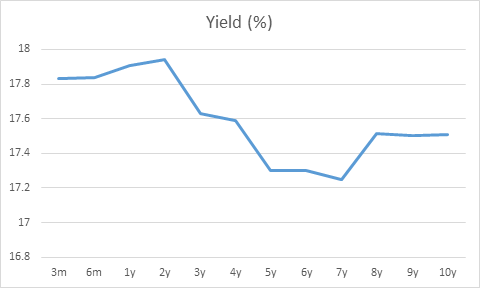

In 2017, after months of election drama and political uncertainty, the country declared the incumbent Uhuru Kenyatta as its president. In the campaign running up to the elections, the president bowing to pressure from the International Monetary Fund, promised to revisit the lending cap law decision as the cap was not conducive to its business environment. The uncertainty surrounding the retention of this cap law caused the yield curve to bull steepen over the past few months.

As the market preferred to buy shorter end paper in order to avoid duration risk in case of the cap removal.

After months of back and forth between members of parliament and the treasury, the former wanting to keep the status quo and the latter desiring for a total repeal or amendment, in August 2018 the lawmakers decided to keep the rate cap (Finance bill 2018). I think as the market starts coming to terms with this decision, liquidity will start to move towards the longer end again, bull steepening in the curve will end and the rate at which short term yields have been falling will slow.

The Brownbear